FTC wants to stop “anticompetitive” vertical deal, but companies question agency’s constitutional authority.

The Federal Trade Commission continues its effort to block as anticompetitive Tempur Sealy International Inc.’s proposed $4 billion purchase of Mattress Firm Group, Inc., a deal that would combine the nation’s largest mattress manufacturer and the largest mattress retailer, but in a suit of their own the companies question the FTC’s constitutional authority.

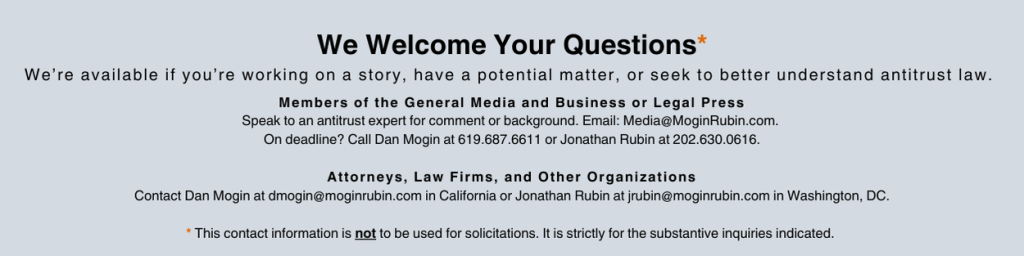

(Read our previous post, Tempur Sealy Acquisition of Mattress Firm: A Vertical Bridge Too Far for the FTC?, written by MoginRubin’s Jonathan Rubin in May 2023 shortly after the deal was announced.)

In July 2024, the Commission filed an administrative complaint as well as a civil complaint in federal court in the Southern District of Texas seeking a preliminary injunction. The FTC claims Tempur Sealy has shown a history of using exclusionary deals to block rivals. Its purchase of Mattress Firm would “further cement its dominance and deprive independent brands of the opportunity to engage in free and fair competition.”

Tempur Sealy answered the complaint in part by saying the government overstated Mattress Firm’s share of the market. The FTC considered website traffic to be a key measure without taking conversion rates into account, the company said.

This marks the first time the FTC has tried to block a vertical deal. It follows the Justice Department’s 2023 caution against conduct that interferes with distribution channels and makes rival products less available.

On Oct. 4, the mattress companies filed a declaratory judgment action arguing that the FTC lacks constitutional authority to bring these actions. Specifically, they say the FTC’s administrative proceedings violate Article III of the Constitution by adjudicating private rights, i.e., contract and property rights, that should be decided in federal court. They also claim violation of the Constitution’s Non-Delegation Doctrine, maintaining that Congress improperly delegated legislative power to the FTC by allowing it to choose between administrative proceedings and federal court without an intelligible principle. They ask for preliminary and permanent injunctions against the FTC’s administrative proceedings, and declarations that the FTC’s actions violate Article III and the Non-Delegation Doctrine.

History of Anticompetitive Practices

In the complaint it filed on July 2, 2024, the FTC claimed Tempur Sealy has shown a history of using exclusionary deals to block rivals. In September 2012, Tempur-Pedic announced its intentions to buy its biggest competitor, Sealy, for $228 million.

Though the public version of the FTC’s complaint is partially redacted, it claims, “Multiple high-ranking executives within Tempur Sealy have expressed a desire to eliminate and block rival mattress suppliers and brands from Mattress Firm post-acquisition.”

In its response, Tempur Sealy denied the validity of the FTC’s claim; however, it conceded the potential accuracy of several quotes from Sealy executives that, in context, would show anti-competitive motives. The direct quotes have been redacted from public viewing.

The mattress giant argued its history of acquisitions shows the company “has neither the incentive nor the plan to abandon Mattress Firm’s successful multi-brand strategy … Tempur Sealy has no incentive to upend the strategy that has made Mattress Firm successful.”

Anticompetitive Benefits

The anticompetitive benefits Tempur Sealy would enjoy if allowed to purchase Mattress Firm would be many. The new company would be able to:

- Suppress competition by limiting rival mattress suppliers’ access to Mattress Firm.

- Disadvantage rivals by offering fewer or less attractive spots in Mattress Firm stores to display their products.

- Pay lower commissions on sales of rival products, and otherwise steer customers away from rivals.

- Deny rivals access to customer insights.

- Access a trove of competitively sensitive information on rivals’ pricing and products.

Proposed Solution

On Sept. 23, 2024, Tempur Sealy issued a press release stating it has agreed to sell 73 Mattress Firm and 103 Sleep Outfitters retail stores to competitor Mattress Warehouse pending the successful purchase of Mattress Firm.

Tempur Sealy Chairman and CEO Scott Thompson said, “As part of our engagement with the FTC on the proposed acquisition of Mattress Firm, we conducted a divestiture process, which led to an agreement with Mattress Warehouse, a company with extensive mattress retail experience, a strong capital base and a capable leadership team.” As part of the deal, Tempur Sealy would continue to provide its products to the divested stores after the closing of the Mattress Firm sale.

Whether this will change the FTC’s position hasn’t been made public, but hearings are scheduled to begin on Nov. 12.

Previous Commentary

For additional insights, read Jonathan Rubin’s May 2023 commentary as the FTC was considering taking action, in which he wrote:

“The FTC is likely to discover a large and growing global industry undergoing significant changes in how mattresses are designed, marketed, and sold in reaction to changing consumer preferences. Several online mattress-in-a-box companies have disrupted the industry. Today, nearly half of all consumers purchases are online …. The Commission would appear to be faced with a fairly competitive market – one in which little or no foreclosure of rivals to the ability to obtain inputs or the availability of channels of distribution to reach consumers will result from the proposed transaction.”

Rubin also noted additional competitive pressure coming from Amazon and Walmart.