“Merger would result in a significant increase in market concentration.”

The U.S. District Court for the District of Oregon has granted a preliminary injunction to halt the proposed $24.6 billion “Big Grocery” merger of Kroger Company and Albertsons Companies, Inc. At least a temporary win for the Federal Trade Commission, the decision comes after a fifteen-day hearing and review of the potential anticompetitive effects of the merger. Attorneys general for the District of Columbia, and Arizona, California, Illinois, Maryland, Nevada, New Mexico, Oregon, and Wyoming joined the FTC in bringing the suit (FTC v. Kroger Company, No. 3:24-cv-00347, D. Oregon). Shortly after the decision, Albertsons sued Kroger for failing to make a good faith effort to ensure the deal would clear antitrust review.

Market Definition and Competition

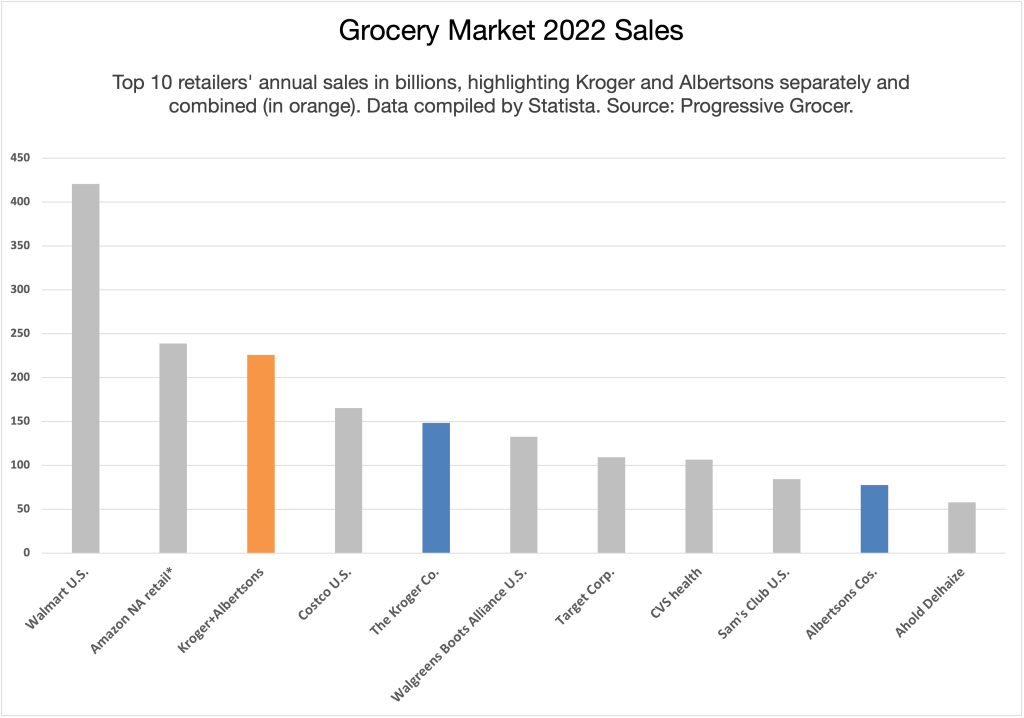

The court identified two relevant product markets: “supermarkets” and “large format stores,” which include traditional supermarkets and supercenters. The merger would lead to undue market concentration in multiple geographic markets, creating a presumption that it would substantially lessen competition. Judge Adrienne Nelson stated, “The evidence shows that the proposed merger would result in a significant increase in market concentration, which is likely to harm competition.”

Loss of Head-to-Head Competition

Evidence showed that Kroger and Albertsons engage in significant head-to-head competition, particularly in pricing and customer service. ” The elimination of this competition would likely lead to higher prices and reduced quality for consumers,” noted Judge Nelson. The merger would eliminate this competition, likely leading to higher prices and reduced quality for consumers.

Rebuttal Evidence

Defendants argued that the merger would generate efficiencies and cost savings, but the court found these claims to be neither merger-specific nor verifiable. ” The efficiencies claimed by the defendants are speculative and not guaranteed to result from the merger,” Judge Nelson remarked. The proposed divestiture of 579 stores to C&S Wholesale Grocers was deemed insufficient to mitigate the anticompetitive effects, given C&S’s limited experience and the complex transition process. ” The divestiture package does not represent a standalone, fully functioning company,” the court noted.

Labor Market Concerns

The court acknowledged the potential impact on union grocery workers but found the evidence insufficient to independently support a preliminary injunction based on labor market competition. “While the labor market theory is compelling, the evidence presented at this time is not sufficient to support an independent injunction,” said Judge Nelson.

Public and Private Equities

The court emphasized the public interest in effective enforcement of antitrust laws, outweighing the private equities presented by the defendants. ” The principal public equity weighing in favor of issuance of preliminary injunctive relief is the public interest in effective enforcement of the antitrust laws,” Judge Nelson stated. The injunction preserves the status quo pending the outcome of the FTC’s administrative proceedings.

Judge Nelson concluded that plaintiffs are likely to succeed on the merits, and the equities weigh in favor of an injunction. Accordingly, the judge granted the FTC’s motion for preliminary injunction. The ruling halts the merger until the FTC completes its review, leaving open the possibility for the companies to pursue the merger at a later date if deemed lawful.

The ruling is a good one for competition at a time when grocery prices are top of mind for many Americans. It was one of the leading factors in the 2024 presidential campaign and is cited as a key consideration among Americans who voted for Donald Trump. Read our previous story about why some state attorneys general dropped out of the case.

Albertsons Sues Kroger

Albertsons filed suit against Kroger in the Delaware Court of Chancery, bringing claims of willful breach of contract and breach of the covenant of good faith and fair dealing. Albertsons alleges Kroger failed to exercise “best efforts” and to take “any and all actions” to secure regulatory approval of the transaction. According to the terms of the merger agreement, Kroger was required to do what it could to get the deal across the finish line. “Kroger willfully breached the Merger Agreement in several key ways, including by repeatedly refusing to divest assets necessary for antitrust approval, ignoring regulators’ feedback, rejecting stronger divestiture buyers and failing to cooperate with Albertsons,” the Idaho-based company said. Kroger says the suit is without merit.

![]()