Would the combined company use improper tactics to foreclose competition?

Review of the $43 billion biopharmaceutical merger of drug giant Pfizer Inc. and biopharmaceutical company Seagen Inc. is under way at the Federal Trade Commission, the Department of Justice, the European Commission, and the U.K. Competition & Markets Authority.

Opinions about the deal’s prospect vary. Some feel there is no problem with the merger; others anticipate deeper scrutiny. The authorities eventually answer whether the merger would harm competition in an important field of research and development or whether it may proceed but with strong competition protections.

“Given the change in anticompetitive tactics employed by pharmaceutical companies, federal agencies investigating mergers like Pfizer’s acquisition of Seagen should expand their review to include analysis of whether the combined company will be able to utilize discount bundling, exclusionary contracts or related tactics to foreclose competition,” MoginRubin’s Tim LaComb recently wrote. If so, he continued, they should consider a challenge.“Doing so would align pharmaceutical merger reviews with the incipiency standard of Section 7 of the Clayton Act, which makes mergers unlawful where the effect ‘may be substantially to lessen competition, or tend to create a monopoly.’”

The government should also consider the importance of research in the drug industry, according to LaComb. “There remain countless diseases and conditions that lack effective treatment, making it critical that as many companies as possible work on developing cures. This will be hampered by pharmaceutical mergers like Pfizer’s acquisition of Seagen. Unlike before the merger, it is no longer in Pfizer’s interest to develop drugs that replace profitable ones produced by Seagen, potentially stifling innovation in this space and reducing future treatment options for patients.”

The companies announced their definitive merger agreement in March 2023. Pfizer said the deal would enhance its position as a leader in oncology given its existing portfolio and Seagen’s “medicines, late-stage development programs and pioneering expertise in antibody drug conjugates.”

Calling this a “$43 billion investment in the battle against cancer,” Pfizer said it will also be a profitable one, that Seagen “could contribute more than $10 billion in risk-adjusted revenues in 2030, with potential significant growth beyond 2030.”

Seagen forecasts it will close out 2023 will $2.2 billion in revenue, which would reflect 12% growth. That includes $1.7 billion in net product sales for its four drugs (listed below), and more than $250 million in royalties, and collaboration and license agreements. It also reports a pipeline of products that would contribute to the treatment of lung, head and neck, and esophageal cancers, as well as advanced melanoma and other solid tumors.

Seagen’s Existing Products and Sales:

Adcetris (brentuximab vedotin) is an antibody drug used to treat relapsed or refractory Hodgkin lymphoma and systemic anaplastic large cell lymphoma, a type of T-cell non-Hodgkin lymphoma. In November 2022, it received approval for the treatment of pediatric patients two years and older with previously untreated high risk classical Hodgkin lymphoma. The approval resulted in a grant of pediatric exclusivity, which extends the period of US market exclusivity by an additional six months, the company reports. Produced by Seagen in the US and Takeda Pharma in Europe. Seagen 2022 sales: $839 million.

Tivdak (tisotumab vedotin) is used to treat advanced cervical cancer that has metastasized or in patients for whom chemotherapy did not or is no longer working. The company reports that in December 2022 the drug was elevated to “preferred regimen” for second-line or subsequent recurrent or metastatic cervical cancer by the National Comprehensive Cancer Network Clinical Practice Guidelines in Oncology for Cervical Cancer Category. Produced by Seagen in the US and Genman A/S in Europe. Seagen 2022 sales: $63 million.

Tukysa (tucatinib) used to treat forms of breast cancer in combination with other medications. 2022 sales: $353 million.

Padcev (enfortumab vedotin-ejfv) is used to treat adults with bladder cancer and cancers of the urinary tract (renal pelvis, ureter or urethra) that has spread or cannot be removed by surgery. 2022 sales: $451 million.

Pfizer says Pfizer Oncology has 24 approved cancer medicines, including therapies for breast and prostate cancer, and generated $12.1 billion in 2022.

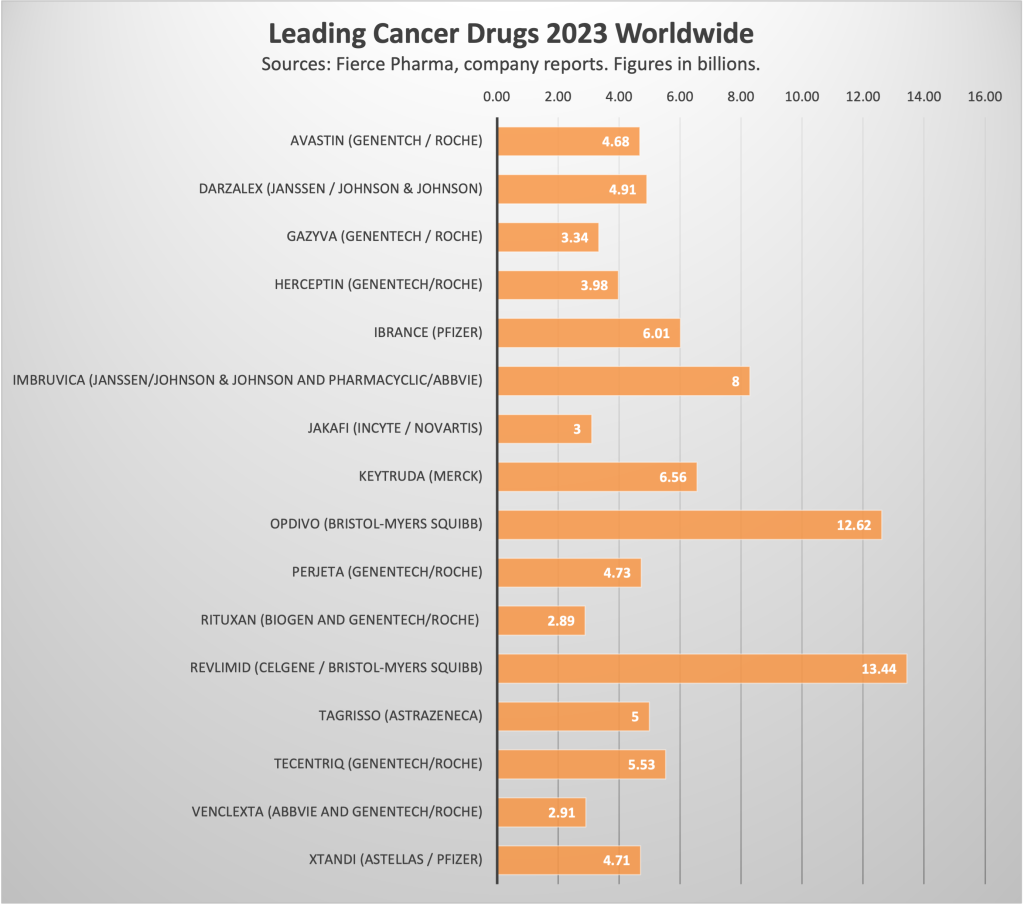

The chart below shows the leading cancer treatment drugs by sales worldwide, which includes two by Pfizer. At present, all four Seagen drugs combined would land on the $2 billion plot point.

Chart by MoginRubin LLP